Struggling with rising coffee costs? This uncertainty makes planning hard for businesses like yours. Let's look at when things might stabilize.

Experts predict high coffee prices might stick around for at least another 8 months. Key factors like weather and strong demand keep pushing costs up, with recent futures prices hitting concerning levels. Stability isn't expected very soon.

Understanding the current situation is key. Let's break down the numbers and reasons behind these high prices, starting with the actual cost right now. Keep reading to get the full picture.

How Much Do Coffee Beans Cost Right Now?

Seeing shocking coffee price tags? It disrupts budgets and makes forecasting tricky. You need clear numbers to plan effectively.

Current coffee bean prices are very high and change often. For example, March 2025 futures recently hit $3.9833 per pound. Prices depend heavily on bean type, quality, and global market shifts.

Getting a single "price" for coffee beans is tough because the market moves constantly. Think of it less as a fixed number and more as a range that shifts daily. A key indicator we watch is the futures market. Recently, the price for contracts delivering in March 2025 reached a high of $3.9833 per pound. This shows that buyers expect prices to remain high well into next year.

Of course, the actual price you pay depends on many things:

- Bean Type: Arabica usually costs more than Robusta.

- Quality & Grade: Specialty beans with high scores command premium prices.

- Origin: Beans from certain regions known for quality are often pricier.

- Purchase Volume: Buying larger amounts might get you a slightly better rate.

- Market Conditions: Day-to-day supply and demand news causes fluctuations.

In my experience running AFPAK, I've seen clients surprised by how quickly price quotes can change. It highlights how important it is to stay informed about market trends when dealing with agricultural products like coffee.

Why Are Coffee Beans So Expensive Currently?

Wondering why your coffee budget is stretched thin? These sudden cost increases hurt profitability. Understanding the causes helps you prepare.

Bad weather, especially drought and heat during flowering, cut supply significantly. At the same time, demand stays strong, and suppliers face pressure. Very low current inventory levels also push prices higher.

Several factors are working together to push coffee prices up right now. A major one is weather. Key growing regions, particularly in Brazil (the world's largest producer), have faced severe drought and high temperatures. This happened at crucial times, like when the coffee plants were flowering, which directly impacts the amount of beans produced. Simply put, less coffee is being harvested.

At the same time, global demand for coffee hasn't really slowed down. People still want their daily cup. Adding to the problem, some suppliers apparently promised more coffee than they could reliably source, creating a scramble in the market. This supply-demand imbalance is a classic recipe for higher prices.

Another critical piece is inventory. Stocks of coffee beans were already low, and the poor harvests haven't helped rebuild them. Recent reports suggest inventory levels are extremely tight, perhaps around only 1.2 million bags for the 2024/25 period. When there's very little backup supply, any disruption has a bigger impact on price. Brazil's own national supply company (CONAB) predicts a 4.4% drop in the country's total 2025/26 coffee output, with Arabica beans hit hardest (down 12.4%). This forecast further supports the idea of continued high prices.

What Are the World's Most Expensive Coffee Beans?

Curious about luxury coffee? While maybe not for daily use, knowing the top end shows coffee's value. It's fascinating stuff!

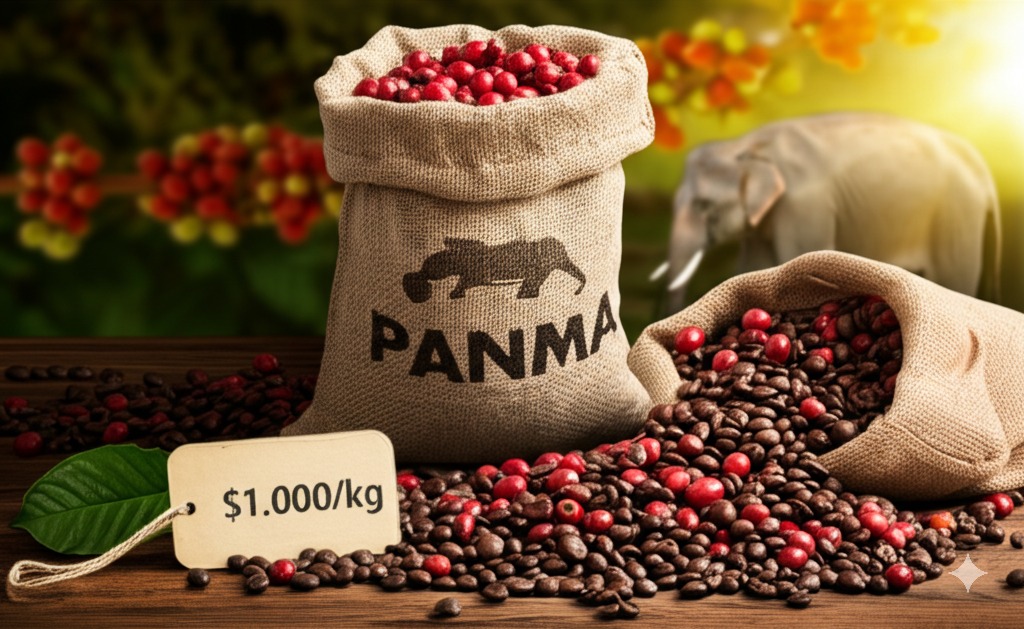

Some coffees fetch incredible prices. Panama Geisha can cost over $10,000/kg at auction. Others like Black Ivory (elephant processed) and Kopi Luwak (civet processed) are famous for unique processing and high cost.

While most of us deal with standard coffee grades, there's a whole other world of ultra-premium, incredibly expensive coffees. These aren't your everyday brews; they are rare, often have unique stories, and command staggering prices. Their cost comes from extreme rarity, complex and sometimes unusual processing methods, exceptional flavor profiles, and high demand from collectors and connoisseurs.

Here are a few examples that really stand out:

| Coffee Name | Approx. Price | Key Feature/Flavor Notes |

|---|---|---|

| Panama Geisha | Up to $10,005/kg (auction) | Highly sought after, known for floral, tea-like, tropical fruit notes |

| Black Ivory Coffee | Around $3,500/kg | Processed through elephants, unique smooth taste, notes of chocolate, fruit |

| Ospina Dynasty | Around $1,580/lb | Grown at high altitudes in Colombia by a historic family, complex flavor |

| Kopi Luwak (Wild) | Up to $1,300/kg | Processed through Asian palm civets, known for rich, smooth taste |

While my work at AFPAK focuses on efficient packaging machinery for more accessible coffees, seeing the prices and processes at this luxury end is always interesting. It shows the incredible value people place on unique coffee experiences. These beans represent the absolute peak of coffee cultivation and processing craftsmanship.

Will Coffee Prices Keep Rising in 2025?

Need to budget for next year? Predicting future costs is vital for business stability. Let's look at the forecasts for 2025.

Yes, signs point to continued high or rising prices into 2025. Brazil's expected lower harvest, very low current stock levels, and strong global demand suggest the upward pressure on prices will persist.

Looking ahead to 2025, the current information suggests that high coffee prices are likely to continue, and they might even rise further. Several key indicators point in this direction.

First, the supply situation doesn't look set to improve quickly. As mentioned, Brazil's official forecast (CONAB) for the 2025/26 harvest, which will impact supply during 2025, predicts a decrease. Specifically, they expect a 4.4% drop overall, with a significant 12.4% reduction in Arabica production. Since Brazil is such a huge player, this shortfall will be felt globally.

Second, existing inventory levels are critically low (around 1.2 million bags estimated for 2024/25). There just isn't much buffer stock to absorb supply shocks or meet unexpected demand spikes.

Third, the market itself seems to be anticipating continued high prices. The fact that March 2025 futures contracts recently traded at $3.9833 per pound shows that professional buyers are locking in supplies at these elevated levels.

Fourth, the overall coffee market is still growing. Projections estimate the global market value reaching nearly $103 billion in 2025, with continued growth expected. Strong underlying demand combined with tight supply usually means prices stay high or go higher. Based on these factors, I'm advising my clients at AFPAK who package coffee products to budget cautiously for 2025.

What Is the Most Popular Coffee Bean Sold Worldwide?

Choosing the right coffee bean matters for product success. Knowing the market leader helps understand trends. Let's see which bean dominates.

Arabica is the most sold coffee bean globally, favored for its nuanced flavor. Although Robusta production is increasing slightly, Arabica still dominates the market despite recent production challenges in key regions like Brazil.

![Arabica vs Robusta Coffee Beans[/caption] Bags of Arabica and Robusta beans side-by-side](https://www.afpakmachine.com/wp-content/uploads/2025/03/Generated-Image-March-26-2025-4_23PM.jpeg)

When you look at the global coffee market, one type of bean clearly stands out as the most popular: Arabica. It makes up the majority of the world's coffee consumption. Why? Primarily because of its taste. Arabica beans are known for their complex flavor profiles, aromatic qualities, and smoother taste compared to the other major type, Robusta.

Robusta beans play an important role too, though. They are generally hardier plants, easier to grow in hotter climates, and contain more caffeine. Their flavor is often described as bolder, stronger, and sometimes harsher or more bitter. Robusta is commonly used in espresso blends (for crema and kick) and in instant coffee. While forecasts suggest Robusta production might increase slightly, it's not enough to overtake Arabica's dominance or offset the projected drop in Arabica supply from key producers like Brazil (which grows about 29% of the world's coffee).

Here’s a simple comparison:

| Feature | Arabica | Robusta |

|---|---|---|

| Market Share | Dominant (Majority) | Smaller, but significant |

| Flavor Profile | Smoother, aromatic, complex | Bolder, harsher, more bitter |

| Caffeine | Lower | Higher (roughly double) |

| Growing Needs | High altitude, specific climate | More adaptable, hotter climates |

| Common Use | Brewed coffee, specialty blends | Espresso blends, instant coffee |

Understanding the difference between these beans is important, even from my perspective in packaging machinery. The type of bean influences the grind, the density, the packaging requirements, and the target market for the final product. The current challenges in Arabica production are a major reason for the price pressures we're seeing across the coffee industry.

Conclusion

The skyrocketing coffee bean prices we’re seeing lately? It’s mostly because of a serious mismatch between supply and demand. On one hand, crazy weather—like droughts and heatwaves—has slashed coffee production big time, leaving us with way fewer beans than usual. On the other hand, the demand side isn’t slowing down at all—in fact, it’s getting worse! Middlemen and coffee traders have locked in a ton of contracts, way more than expected, which keeps the demand sky-high. So, with less coffee to go around and buyers still clamoring for more, prices just won’t come down anytime soon.